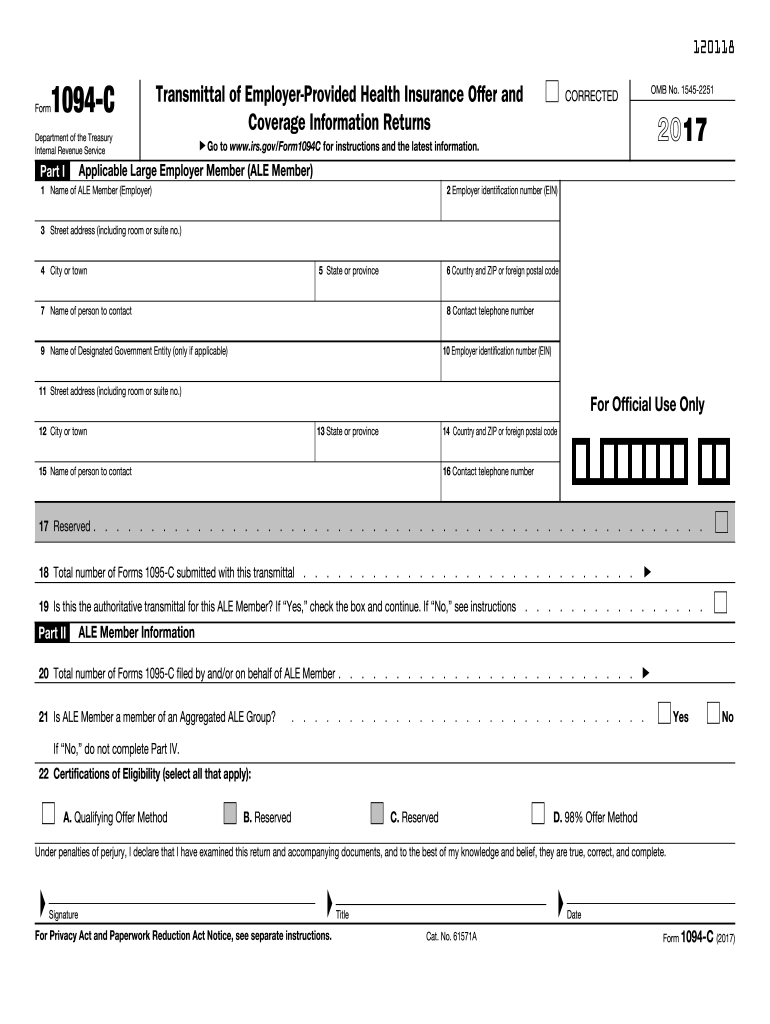

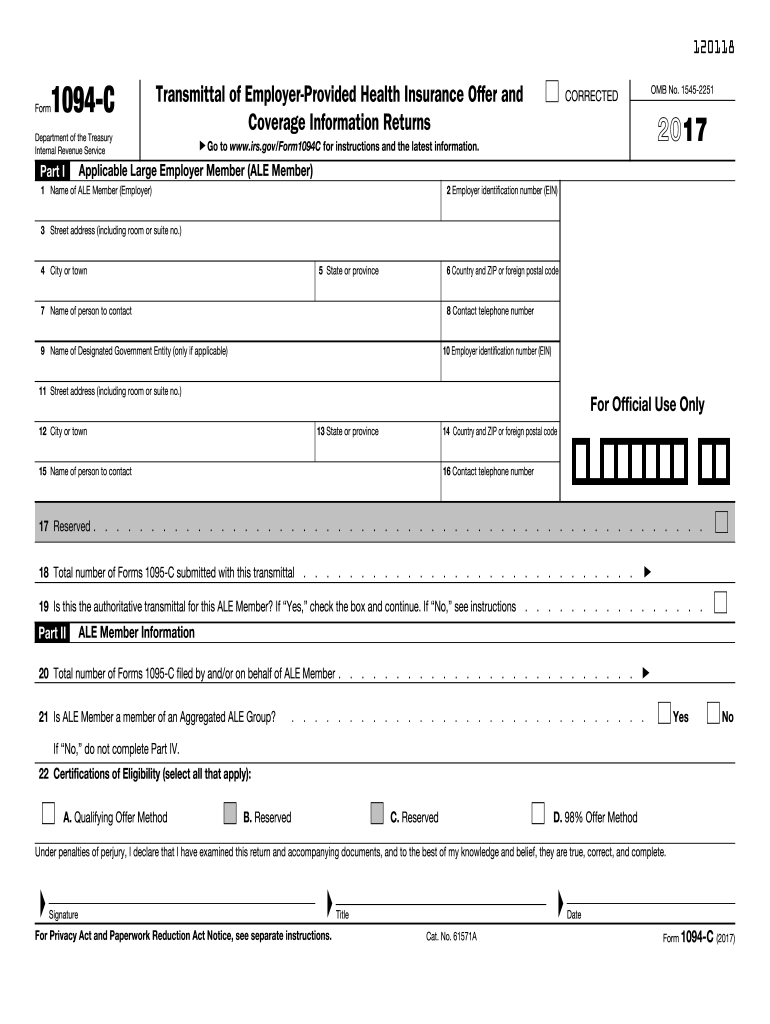

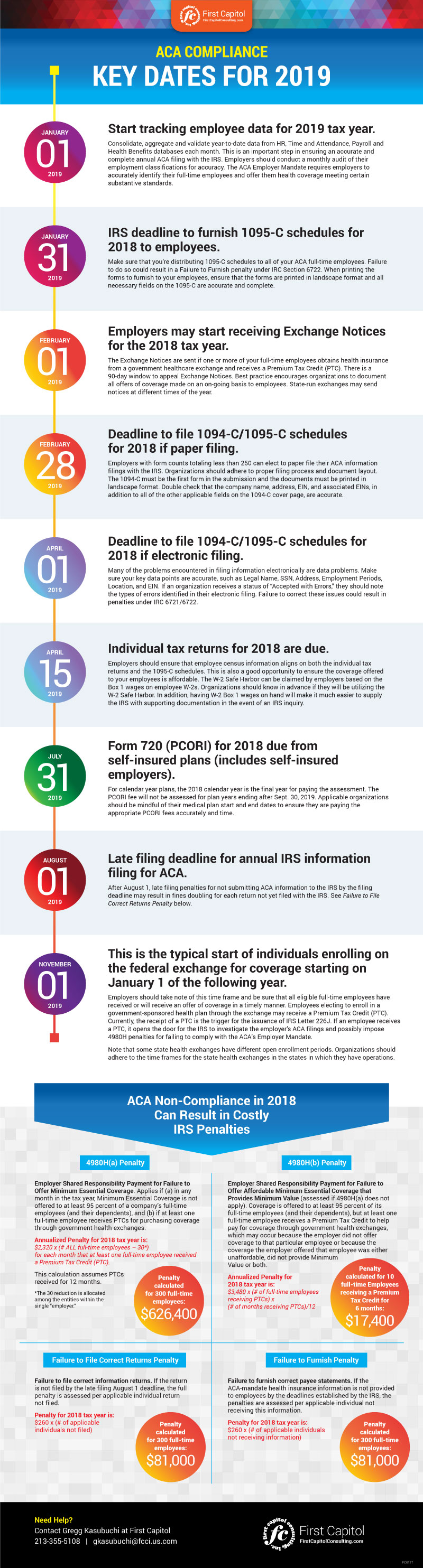

The IRS has released the final 1094/1095C schedules and reporting instructions for the 18 tax year, to be filed and furnished in 19 You can find the 18 instructions at this link The new 18 version of Form 1094C and Form 1095C are available at these links 18 Form 1094C Changes to the Form 1094C There are no other substantive changes to the Form 1094C Deadlines As of now an employer will have to furnish the 18 Form 1095C to certain employees by The Form 1095C is by far the more complicated Form and providers who are not automating the process will undoubtedly struggle to meet this 1094C/1095C 18 Deadlines Similar to notices issued in prior years, the IRS has once again issued a notice granting an extension for providing employees a copy of Form 1095C In Notice 1806, the IRS extended the deadline for giving Form 1095C to employees from to

17 Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

1094 c form instructions 2018

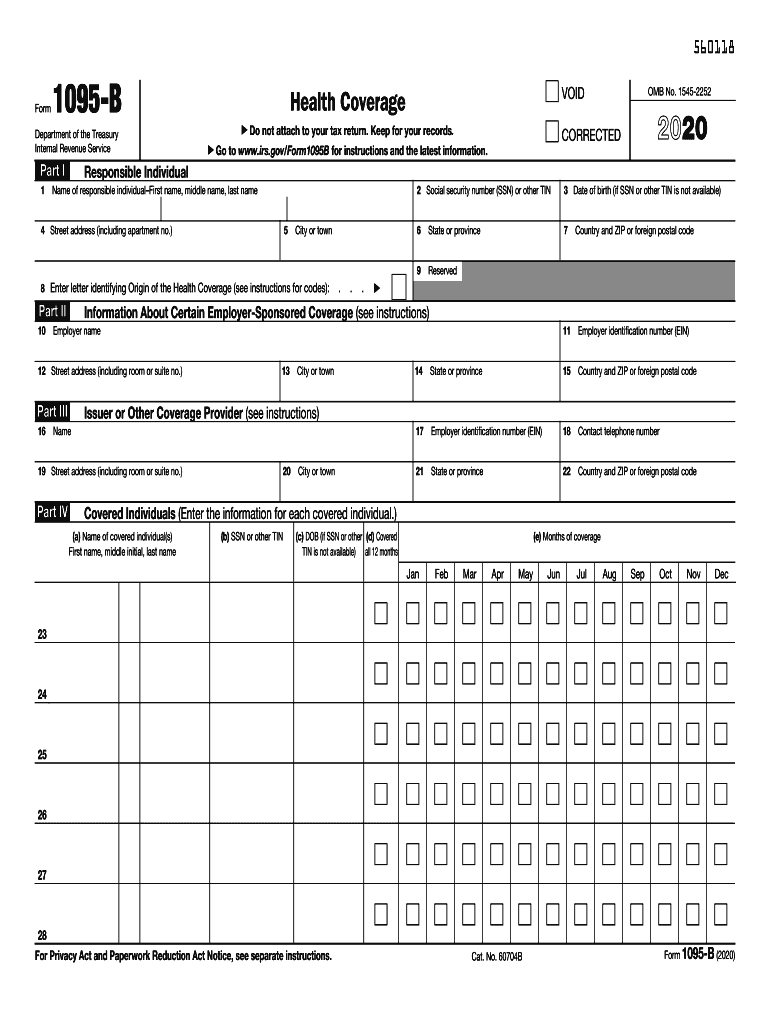

1094 c form instructions 2018-Otherwise, electronic filing is encouraged, but not requiredForm 1094B Transmittal of Health Coverage Information Returns Inst 1094B and 1095B Instructions for Forms 1094B and 1095B Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns

1

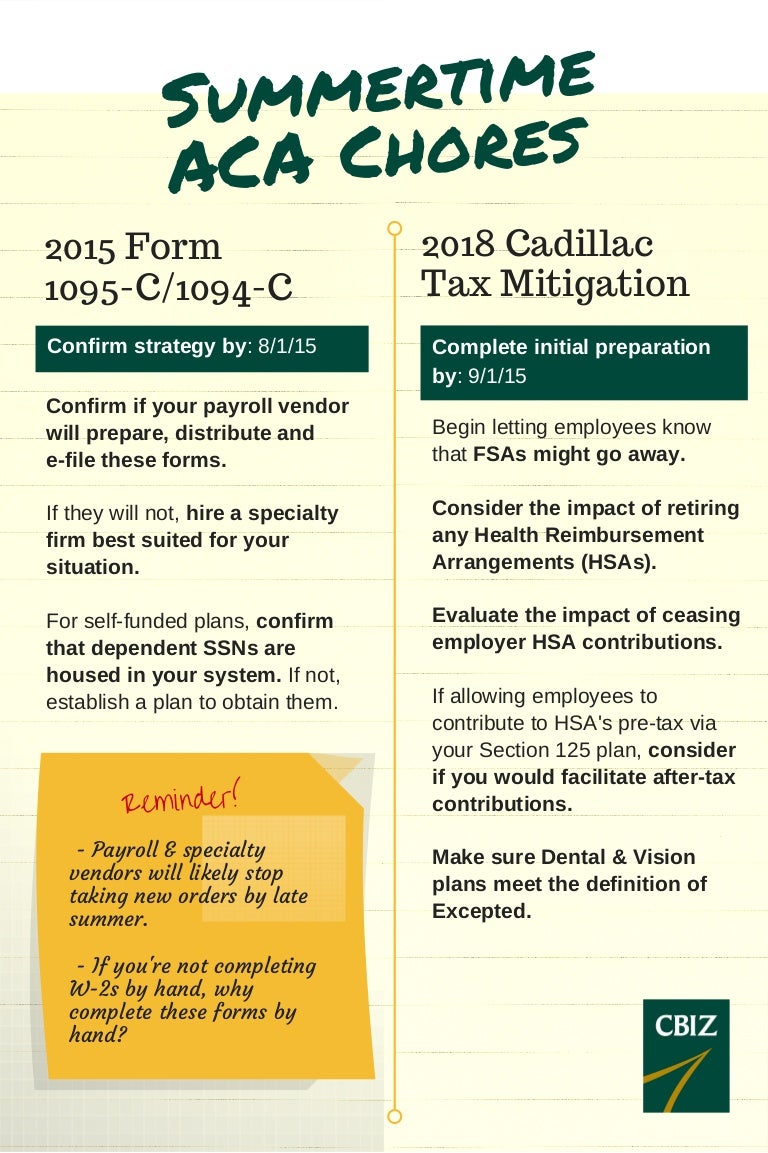

Similar to the 1094C and 1095C corrections, the 16 Instructions for Forms 1094B and 1095B contain discussions on correction methods and Section 71 of Publication 5165 is the source for instructions for making a correction to a Form 1095B filed electronicallyIf a substitute form is used, this form must meet all the content requirements of the IRS and should include every piece of information needed for Form 1094C and Form 1095C In 17, the IRS provided draft instructions for forms 1094, 1095, and other forms required for ACA reporting This is the deadline for filing the Form 1094C transmittal (and copies of related Forms 1095C) with the IRS, if you are filing electronically Electronic filing is mandatory if you are required to file 250 or more Forms 1095C for the 17 calendar year;

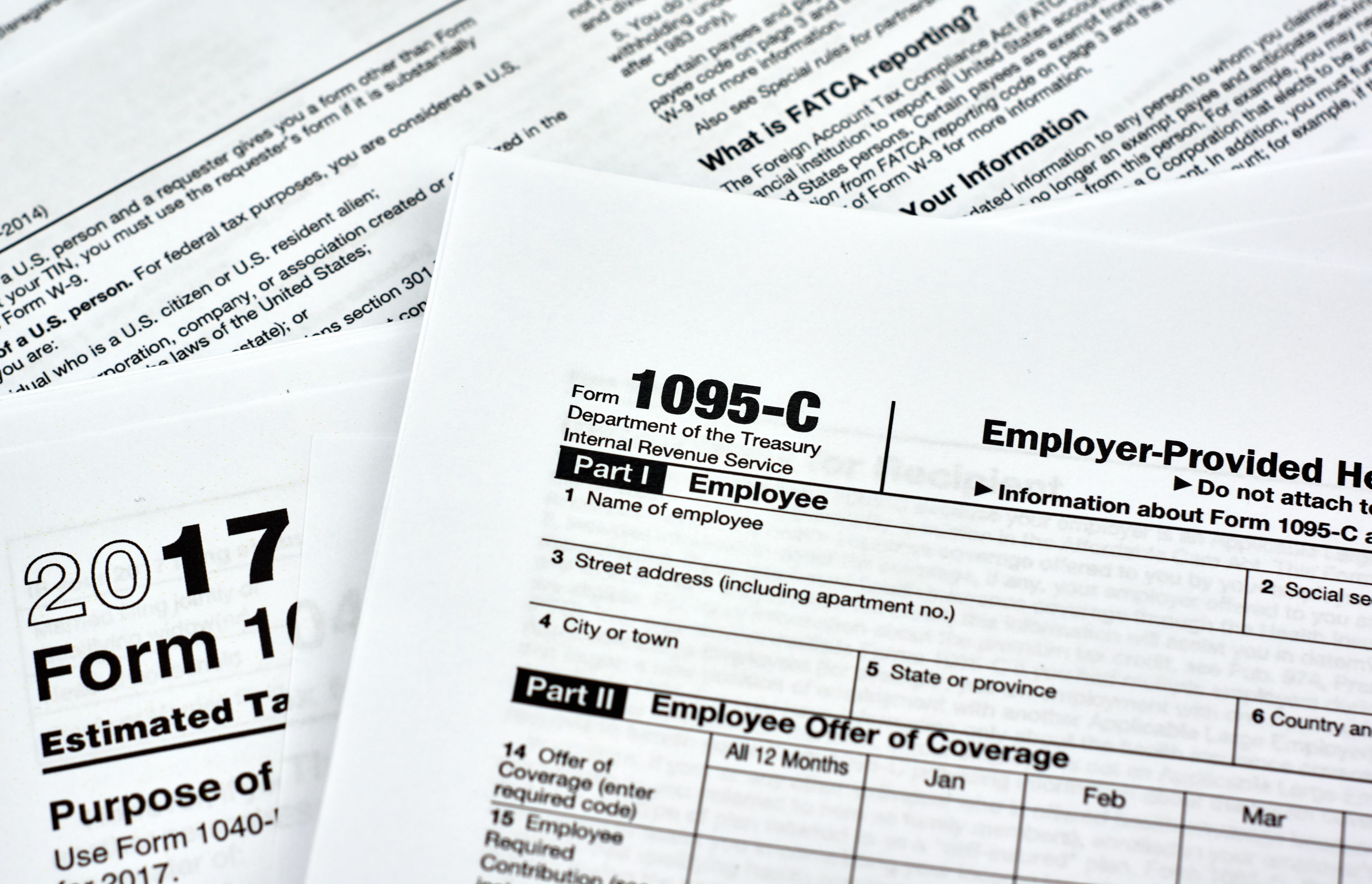

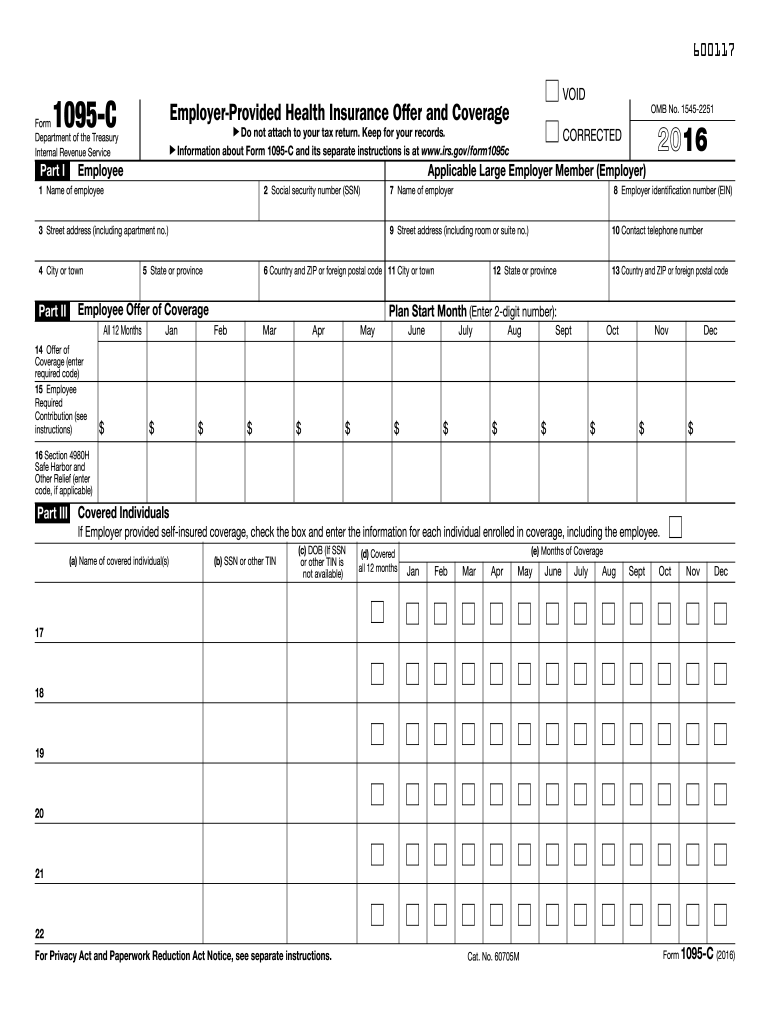

File Forms 1095C with the IRS for each fulltime employee, along with Form 1094C (the transmittal form) An IRS Q&A provides more information on 1095 filing requirementsForm 1094C (18) 1218 Form 1094C (18) Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTime Employee Count for ALE Member (c) Total Employee Count for ALE Member (d) Aggregated Group Indicator (e) Reserved 23; Form 1094C, line 22, Box C is designated as "Reserved" Form 1094C, Part III, column (e) is designated as "Reserved" and the entry rows in the column are shaded Furnishing and filing deadlines for 17 forms Furnishing deadline for Forms 1095C to employees

18 Form 1095C (employee statement) Due 18 Form 1094C (transmittal form with copies of Forms 1095C) Due (or , if filing electronically) If the due date falls on a weekend or legal holiday, theEmployers are responsible for furnishing their employees with a Form 1095C by Thursday, Employers are still responsible for filing copies of Form 1095C with the IRS by Thursday, , if filing by paper or Monday, , if filing electronically (same as Form 1094C) As summarized above, employers should correct errors on Forms 1094C and 1095C, enter "X" in the CORRECTED checkbox and refile the form with the IRS The vendor you used to file electronically should be able to provide direction for this process Furnish corrected Forms 1095C to affected individuals as soon as practicable

Instructions For Forms 1095 C Taxbandits Youtube

Nj Employers And Out Of State Employers With Nj Residents Prepare State Updates Website On Employer Reporting For New Jersey Health Insurance Mandate Health Employment And Labor

HRB 141 provides information, guidance and insight on the following topics 18 Forms and Instructions for 1094/1095 Series ACA Reporting Forms Form 1094C summarizes the ALE's 1095C information returns as well as details pertaining to the organization, such as EIN, address, point of contact, and certifications of eligibility regarding the health insurance offered for a particular year Specifically, Form 1094CForm 1094C is the transmittal form that accompanies the employer's Forms 1095C submitted to the IRS But in addition to serving as a transmittal form, like a W3, the employer also uses Form 1094C to demonstrate compliance with the "95 percent"

Irs Extends Form 1095 Distribution Deadline To March 4

Irp Cdn Multiscreensite Com Fd05f735 Files Uploaded Aca user guide to the 1095 C form and associated codes Pdf

The IRS has finalized Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 18 tax yearContact support How do I fill out the CAT 18 application form?Forms and Publications (PDF) Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms

1

Your 1095 C Obligations Explained

Prior Year Products Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printingForms and Publications (PDF) Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on1094 C 18 Form FAQs Hit on answers to listed questions about 1094 C 18 Form Discover the most ordinary topics and more Need help?

Document

17 Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

18 Instructions for Forms 1094C and 1095C Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless A Form 1094C must be filed when an ALE Member files one or more Forms 1095C An ALE Member may choose to filePrint and sign your 1094C Form, make a photocopy for yourself, place it in the package with your printed 1095C(s), and mail it to the IRS no later than If you are Filing your Information Return Electronically, select the correct 1094C Transaction you have created, and generate your electronic files (Sec6) 10If this Form 1094C transmittal is the Authoritative Transmittal that reports aggregate employerlevel data for the ALE Member, check the box on line 19 and complete Parts II, III, and IV, to the extent applicable Otherwise, complete the signature portion of Form 1094C and leave the remainder of Parts II, III, and IV blank

Bundle For 100 Employees Complyright Ac1095e0s 1095 C Employer Provided Health Insurance Offer And Coverage Form With Envelopes And Aca Software Forms Recordkeeping Money Handling Office Supplies Emosens Fr

2

Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095CThe 18 Form 1094C and all supporting Forms 1095C (collectively, "the return") is due to the IRS by if filing electronically (or if filing by paper) These deadlines were not extended as part of the relief announced in Notice 14 Draft C Form Instructions The IRS has released draft Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 18 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to

Instructions For Forms 1095 C Taxbandits Youtube

2

Form 1094C must be used to report to the IRS summary information for each ALE Member (defined below) and to transmit Forms 1095C to the IRS Form 1095C is used to report information about each employee to the IRS and to the employee The only thing that appears to have changed on the Form 1094C is the year switched from 17 to 18 Given our expertise in the ACA field we anticipated this change occurring That is sarcasm in case you missed it After reviewing the draft Form 1094C there are no other obvious differences compared to prior years The deadlines to furnish statements to individuals and to file with the IRS have been updated from 17 to 18 Consistent with the changes to Form 1094C, references to the Section 4980H transition relief have been removed The instructions address several minor issues affecting Form 1095C

2

Irs Releases Final Forms And Instructions For 17 Aca Reporting

18 Form 1094C/1095C Instructions – Penalties for reporting failures and errors will increase to $270 per violation up to an annual maximum of $3,275,500 Please note Penalty limits apply separately to IRS information returns and individual statements 1094C/1095C Deadlines Form 1095C must be sent out to employees byUnlimted ACA Form Printing with ez1095; Form 1094B is essentially a cover sheet used by insurance providers when they send the Internal Revenue Service (IRS) information about who has health coverage that meets the standards of the Affordable Care Act The 1094B is a brief form that takes up less than a page

Www Irs Gov Pub Irs Drop N 18 94 Pdf

Irs Issues Aca 18 Forms 1094 C And 1095 C Instructions And 226j For 16 The Aca Times

The IRS imposes penalties for late filing of Forms 1094C and 1095C or for late furnishing of Forms 1095C under Internal Revenue Code (IRC) Sections 6721 and 6722 These penalties can be huge depending on the number of late Forms 1095C, at a rate of $270 per form for failure to file and an additional $270 per form for failure to furnish forMailing Instructions for Filing Paper Forms 1094C and 1095c Updated For Administrators and Employees Here are some general tips for employers who wish to file their Forms 1094C and 1095C by mail Send the forms to the IRS in a flat mailing (not folded) Applicable large employers (ALEs)—generally those with 50 or more fulltime employees, including fulltime equivalents—must file Forms 1094C and 1095C with the IRS no later than (or if filing electronically) ALEs must also furnish a Form 1095C to all fulltime employees by *

Vehi Org Client Media Files 02 Irs Reporting Webinar Vehi Resource Guide Overview 9 25 18 2a12 3 18 Pdf

2

The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby you offer sufficient insurance If you don't satisfy the Employer Mandate, there are fines IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095CThe way to complete the 1094 c 18 form online To start the blank, use the Fill & Sign Online button or tick the preview image of the form The advanced tools of the editor will guide you through the editable PDF template Enter your official contact and identification details

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

Form 1095 A 1095 B 1095 C And Instructions

There is a detailed instruction on how to fill up the form on the CAT website Both written and a video format The instructions are easy toForm 1094C () 1218 Form 1094C () Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTime Employee Count for ALE Member (c) Total Employee Count for ALE Member (d) Aggregated Group Indicator (e) Reserved 23;This relief applied only to incorrect and incomplete information, and not for failure to furnish or failure to file Forms 1094C/1095C Notice 14 extends this relief to 18 Forms 1094C/1095C ALEs will be eligible for relief if they can show that they made goodfaith efforts to comply with the reporting requirements for correct and

2

2

October 18 The Internal Revenue Service ("IRS") has released the final 18 version of the Affordable are Act ("AA") Information Reporting forms, aka Forms 1094 and 1095 and instructions Applicable Large Employers ("ALEs")¹ are obligated to issue and file the 18 AA information returns Other than some formatting1921 form 1094c Fill out documents electronically using PDF or Word format Make them reusable by creating templates, add and complete fillable fields Approve documents with a legal digital signature and share them by using email, fax or print them out Save files on your laptop or mobile device Increase your efficiency with powerful service?Form 1094C Filing Deadline Beginning with the 18 tax year, employers must file Form 1094C to the IRS with Form 1095C Both forms are due to the IRS by February 28th (if paper filing) or April 01nd (if efiling) of the year following the calendar year the return references

2

2

No preprinted forms are needed to print 1095 and 1094 Formsez1095 can print ACA form 1095B, 1094B, 1095C & 1094C The 1094C form allows employers to report that by allowing spaces to report on a monthbymonth basis as shown below 179 180 After you report whether you offered at least minimum essential coverage or not, the IRS wants to know how many full time employees the reporting ALEM had on a monthtomonth basis 180 181

The Irs Is Issuing New Aca Penalties Against Employers Accounting Today

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Year End Tax Due Dates 18 Withum

2

How To Correct Aca Information Reporting Errors Forms 1094 And 1095 Aris Business

2

2

1095 Tax Form 17 New Form Tax11irs F1042 Page 1 Fascinating 1042 Templates Models Form Ideas

Remote Sensing Free Full Text A Computational Workflow For Generating A Voxel Based Design Approach Based On Subtractive Shading Envelopes And Attribute Information Of Point Cloud Data Html

Form 1095 A 1095 B 1095 C And Instructions

Www Cowdenassociates Com Wp Content Uploads 18 10 Irs Issues Letter 5699 To Noncompliant Employers Pdf

Form 1095 C H R Block

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Www Cbiz Com Linkclick Aspx Fileticket Tiiy1s9y5pg 3d Portalid 0

Updated Irs Reporting Requirements Babb Insurance

Aca Reporting In 18 Need To Know Items Narfa

1095c Form Acaprime Com

Www Hayscompanies Com Wp Content Uploads 18 10 Here Come The 1095s Pdf

Complyright 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 500 Employees Amazon In Office Products

Prepare For Early 18 Aca Information Reporting On Health Coverage

Irs 1095 B 21 Fill Out Tax Template Online Us Legal Forms

Www Irs Gov Pub Irs Prior Ib 18 Pdf

Www Gadoe Org Technology Services Pcgenesis Documents Aca Test File Submission Pdf

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Www Tasconline Com Uploads Aca reporting Tc 6051 18 aca quick start guide Pdf

Www Irs Gov Pub Irs Utl Instructions for ty17 criteria Based aats scenarios Pdf

Your 1095 C Obligations Explained

2

Aca Requirements Checklist

2

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

3

Tax Form 1094 C Transmittal Of Employer Health 1094ct Mines Press

Fill Free Fillable Irs Pdf Forms

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

Form 1095 C 17 Fresh 1094 B 1095 Software 599 Form C Models Form Ideas

Admin Abcsignup Com Files 7b0f 03da 4619 Add5 95b8fc087aa3 7d 6 Adpproconference Acapreparenowforaseamless18filing Pdf

Mark These 19 Dates For 18 Aca Reporting Update The Aca Times

2

What Is The Form 1095 C Youtube

Zortec Payroll Affordable Care Act Ppt Download

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

Www Stephens Com Globalassets Insurance Webinars What Employers Need To Know About Irs Reporting In 19 Pdf

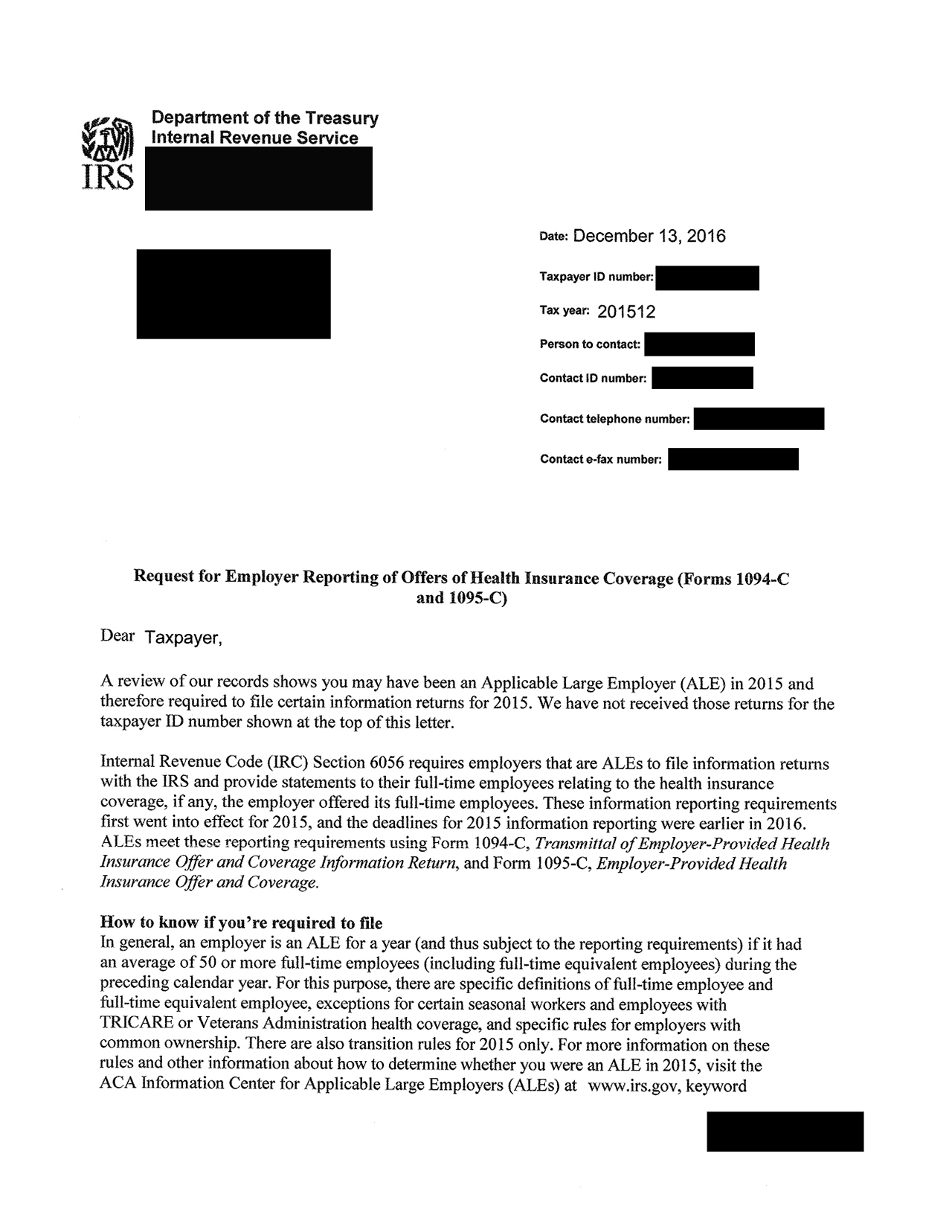

Aca Reporting And The Irs What To Know About The Letter You Received The Aca Times

Blog Irs Reporting

2

Www Irs Gov Pub Irs Utl Instructions for ty18 predefined aats scenarios Pdf

Irs Slashes Insurers 19 Aca Coverage Reporting Burden Thoughtful Advisors

Irs Final Aca Compliance Forms Now Available Bernieportal

Irs Releases Draft Forms And Instructions For 18 Aca Reporting Snellings Walters

Irs Releases Final 18 Aca Reporting Forms And Instructions Health E Fx

2

Blog Irs Reporting

Www Dfwiscebs Org Uploads 1 2 0 2 Feb 13th Presentation Pdf

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

2

2

2

Datatechag Com Ag Web Docs How To file aca information returns Pdf

2

2

Irs Memo Concludes There Is No Statute Of Limitations For Aca Employer Mandate Penalties Under Internal Revenue Code 4980h Workforce Bulletin

Prepare For Early 18 Aca Information Reporting On Health Coverage

Zortec Payroll Affordable Care Act Ppt Download

2

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Www Advancesradonc Org Article S2452 1094 18 0 Pdf

2

2

Q Tbn And9gcrkv0eivjd2lvnvsnjzd0hwmco6gove1hitfp7wdnojwps1lvpe Usqp Cau

2

2

Www Irs Gov Pub Irs Utl Instructions for ty18 criteria Based aats scenarios Pdf

1

Www Advancesradonc Org Article S2452 1094 18 0 Pdf

2

19 Aca Reporting Timeline Pomeroy Group

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

2

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

0 件のコメント:

コメントを投稿